Building the Intelligent Infrastructure for Early-Stage Investing

TAG Capital GmbH brings structure, transparency and analytical depth to the evolving world of early-stage venture investment.

The Market Reality: Effort Without Infrastructure

+

Hours per deal is an Average time from first contact to investment decision

Months Typical fundraising cycle for founders

The Intelligence Gap

Early-stage investing today runs on effort, instinct and informal systems rather than structured intelligence. This creates a profound mismatch between investor ambition and actual capability.

The Deal Effort Problem

A typical early-stage deal takes several months from first contact to decision and requires extensive effort across sourcing, screening, diligence and follow-up. Studies from the angel and venture ecosystem consistently show that investors spend well over one hundred hours per completed deal across these stages.

The Team Capacity Crunch

At the same time, most early-stage investors operate with very lean teams, often without dedicated analysts or operations staff. The mathematics simply don't work.

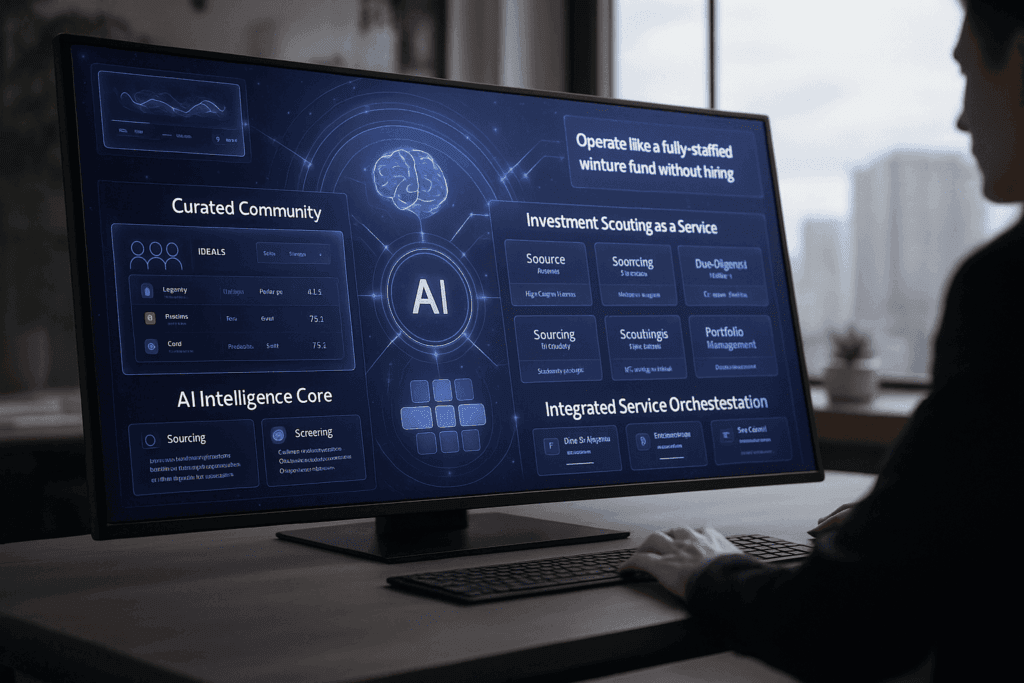

TAG Capital's Three-Layer Ecosystem

Together, these layers form an integrated ecosystem for intelligent early-stage capital allocation. Each component serves a distinct purpose, yet all are deeply interconnected, creating a whole that is greater than the sum of its parts.

How TAG Orchestrates Intelligence, Community, and Operations

At the centre sits Invessence, our intelligence layer that transforms how investors process and understand opportunities.

Around it, Friends of TAG builds a curated and structured founder community focused on genuine readiness rather than superficial exposure. Extending from both, our Investment Operations as a Service offering provides operational capability to investors who want the discipline of a professional venture team without the burden of building one internally.

Join the Ecosystem

TAG Capital GmbH is creating the conditions where capital can move with intelligence, purpose and trust. We invite you to become part of this ecosystem.