Invessence

The Intelligence Layer

Structured Intelligence for Early-Stage Investors

Invessence is the analytical core of TAG Capital. It is designed to support how early-stage investors actually think and decide, not how software vendors imagine they should work.

Invessence ingests founder materials and interactions—pitch decks, submissions, notes and follow-up conversations. It structures this information and aligns it with an investor’s specific thesis, sector focus and constraints.

Core Pillars of Invessence

Data Ingestion

Capture information from multiple channels and formats

Structural Analysis

Extract, enrich and contextualise company data

Thesis Alignment

Map opportunities against specific investment criteria

Explainable Insights

Generate structured analysis that supports informed decisions

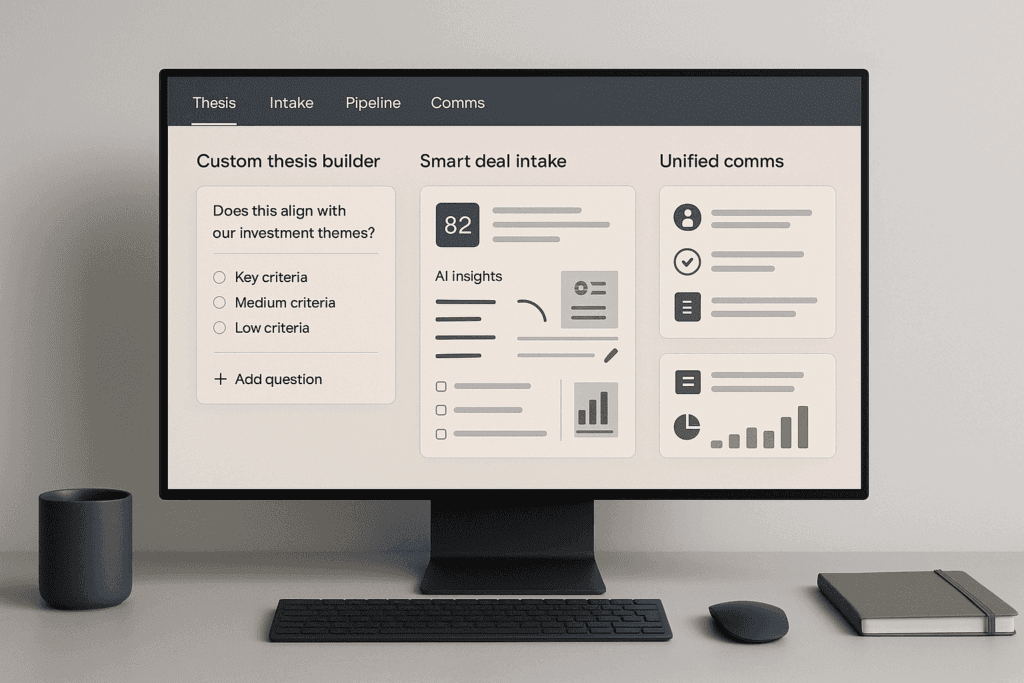

Intuitive interface for early-stage deal workflows from thesis setup to diligence.

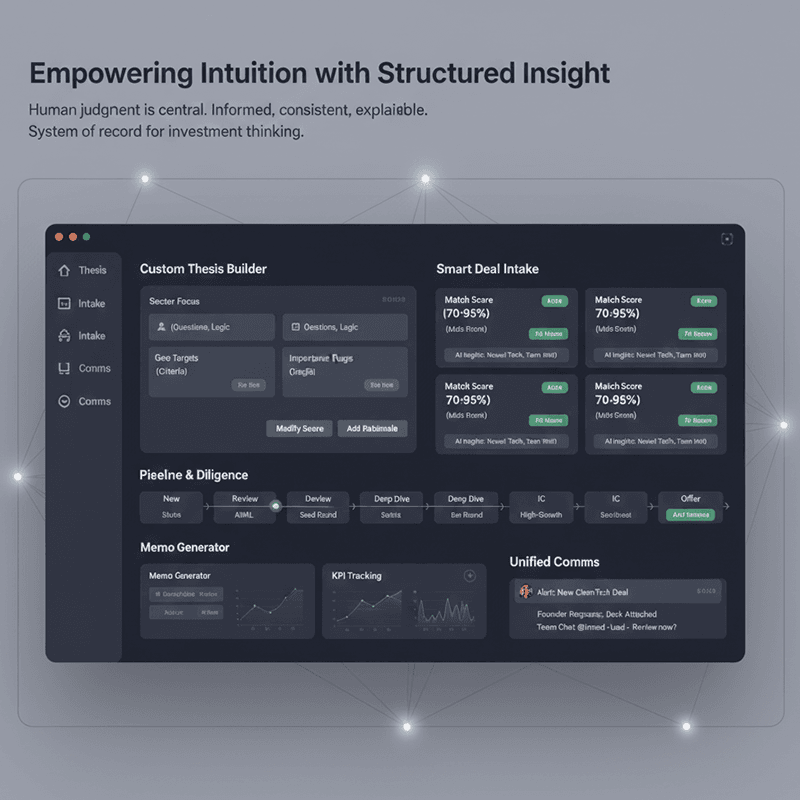

- Custom Thesis Builder: Define criteria with questions, branching logic, importance flags

- Smart Deal Intake: Parse and score applications, view AI insights, and modify with rationale.

- Pipeline & Diligence: Visual stages, tags, templates, memo generator, and KPI tracking.

- Unified Comms: Alerts, founder responses, and team coordination from one dashboard.

Empowering Intuition with Structured Insight

Crucially, Invessence does not attempt to remove intuition from early-stage investing. Human judgement and gut feeling are irreplaceable at the earliest stages. Invessence exists to support this intuition by ensuring it is informed, consistent and explainable. The system produces insights that help investors prioritise opportunities, prepare for conversations and carry out disciplined diligence.

Invessence serves as the system of record for investment thinking. It makes reasoning visible, comparable and easier to revisit over time.

For Investors

Access a consistent and enriched flow of founder information.

Each interaction, update and feedback loop improves the collective intelligence of the system, creating compounding value.