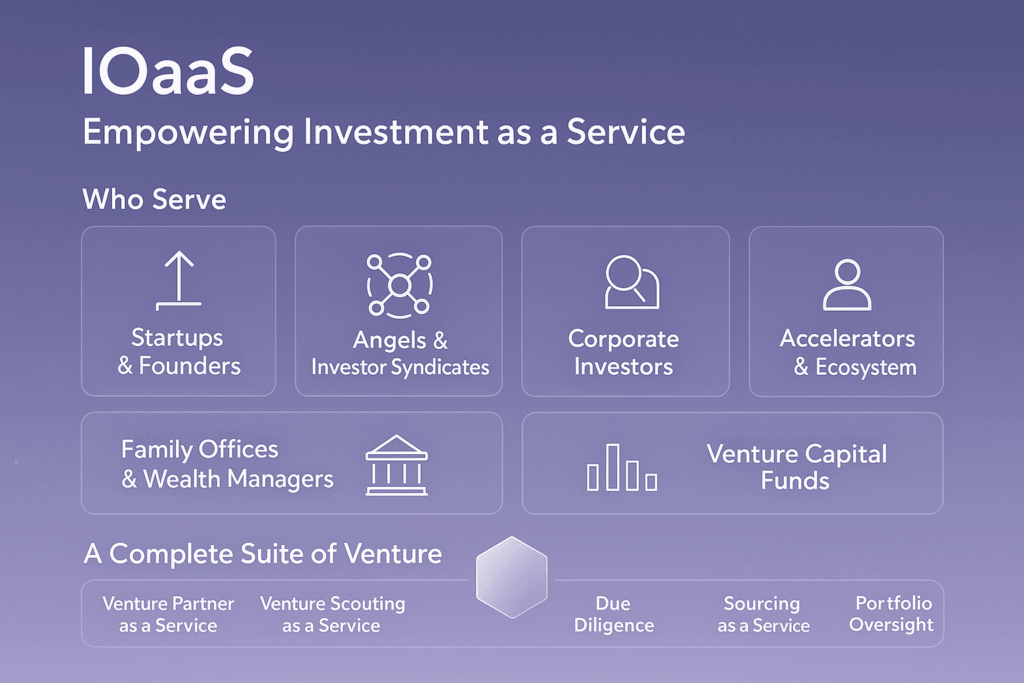

Investment Operations

as a Service

Who We Serve

Startups and Founders

Gain structured feedback, clearer understanding of investor expectations and a path to genuine readiness. Move from noise to clarity.

Angels and Investor Syndicates

Access a shared intelligence layer that improves collective decision-making whilst preserving individual perspectives and judgement.

Corporate Investors

Access targeted venture scouting aligned with strategic mandates. Maintain clear governance and reporting standards throughout.

Family Offices and Wealth Managers

Enable structured participation in early-stage investing without building internal teams. Gain governance-ready processes and reporting.

Venture Capital Funds

Expand analytical capacity without diluting culture. Support faster screening and more structured workflows during high-intensity periods.

Accelerators and Ecosystem Partners

Integrate structured evaluation and readiness support. Offer clearer outcomes to founders whilst simplifying investor engagement.

The Changing Landscape of Early-Stage Investing

The third layer of the TAG ecosystem turns intelligence and community into action.

Investment Operations as a Service provides managed operational support to investors who want the structure of a professional venture organisation without building a full internal team.

A Complete Suite of Venture Services

Services are modular and can be adopted individually or as a full operational framework. This allows investors to focus on judgement and relationships, while TAG manages the discipline and continuity of the process.

Venture Partner as a Service

Thesis design, decision frameworks and investment committee preparation

Venture Scouting as a Service

Tailored for corporates or thematic mandates seeking targeted exposure

Due Diligence as a Service

Structured memos, comparative analysis and coordinated expert inputs

Sourcing as a Service

Structured, thesis-aligned sourcing workflows using events, networks and community data

Portfolio Oversight as a Service

Structured founder updates, KPI tracking and governance-ready materials

Designed for Every Investor

This offering is designed for family offices, angel syndicates, wealth managers, emerging venture funds, corporate innovation units and organised investor forums.

Rather than isolated consulting, this layer extends Invessence into day-to-day workflows and leverages the Friends of TAG community as a sourcing and evaluation foundation.